Legal considerations for foreign investors acquiring Spanish companies or entering joint ventures, including due diligence, approvals, and cultural integration factors

Spain has become one of Europe’s most attractive destinations for cross-border mergers and acquisitions.

As global capital looks for resilient opportunities, cross-border M&A Spain has become a gateway between Europe, Latin America, and North Africa.

Spain has become a prime choice for companies considering acquisitions or joint ventures.

If your organisation is seeking trusted guidance, professional M&A advisory in Spain plays a crucial role in helping you secure these opportunities.

With expert M&A advisory services for international investors in Spain, businesses can move confidently through every stage of a transaction, from strategy to execution.

Key highlights of cross-border M&A Spain

- Progressive regulatory reforms that simplify foreign investment approval processes

- Greater legal certainty thanks to modernised corporate governance frameworks

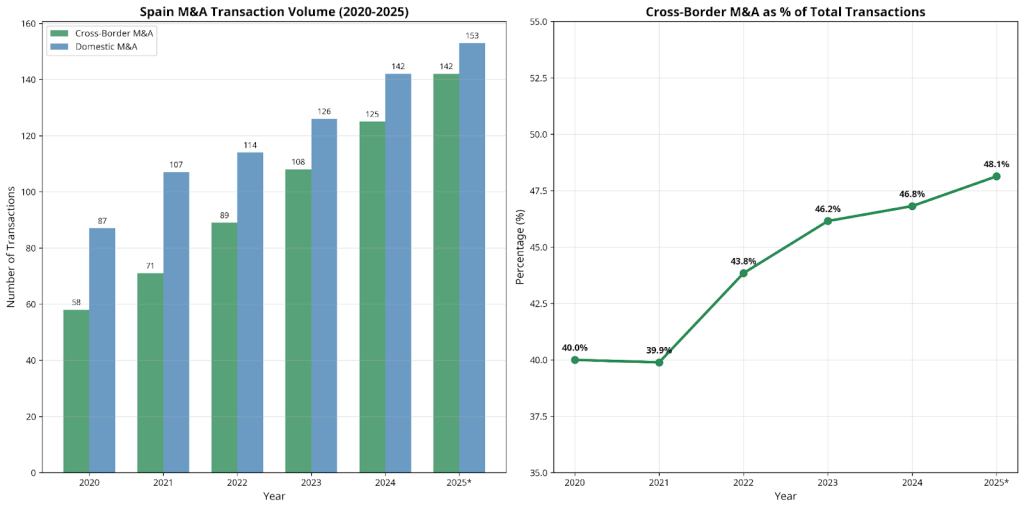

- Rising cross-border deal activity, with 48% of transactions involving foreign investors

- Access to tax-efficient structuring opportunities through the EU directive advantages

- Strong sectoral growth in technology, healthcare, and renewable energy

Understanding Spain’s wider commercial law framework is key to making sense of recent M&A developments.

At the same time, professional M&A advisory in Spain, combined with expert tax and accounting services, is vital for structuring transactions effectively and ensuring smooth post-completion integration.

For international buyers, relying on M&A advisory services for international investors in Spain provides the guidance needed to navigate both legal and financial complexities with confidence.

Spain’s M&A Legal Framework in 2025

Regulatory environment and key legislation

Spain’s mergers and acquisitions framework is built on a sophisticated mix of domestic law and European Union directives.

Within Spain

At the national level, the Spanish Companies Act (Ley de Sociedades de Capital) is the main piece of legislation governing corporate deals. It sets out the rules for share acquisitions, asset transfers, and corporate restructuring in detail.

Within the EU

On a European level, the EU Merger Regulation plays a central role, especially in takeovers involving foreign buyers.

Large-scale transactions that meet certain thresholds are overseen by the European Commission rather than national authorities.

Specifically, this applies when the combined worldwide turnover of the companies exceeds €5 billion, and at least two of them each record EU-wide turnover above €250 million.

Internationally

Spain has also strengthened its Foreign Direct Investment (FDI) screening mechanism in line with the EU FDI Screening Regulation.

As of today, government approval is required for foreign investment in strategic areas such as defence, energy, telecommunications, and critical infrastructure.

The thresholds vary depending on both the investor’s country of origin and the nature of the target company’s business.

Transaction Types and Structures

Foreign investors looking to acquire a Spanish company must navigate several possible deal structures.

Each option carries different advantages depending on the goals of the transaction, tax implications, and operational requirements.

Key transaction structure options

- Share Acquisition: Direct purchase of a target company’s shares, offering immediate control and continuity of operations.

- Asset Acquisition: Purchase of specific business assets, allowing selective assumption of liabilities and greater deal flexibility.

- Joint Ventures: Collaborative arrangements that combine foreign capital with local expertise and market knowledge.

- Cross-Border M&A Spain : Full legal integration under the EU directive framework, enabling sophisticated international combinations.

Investment approvals and regulatory clearances

- FDI approvals and screening for foreign investors are now central to M&A in Spain.

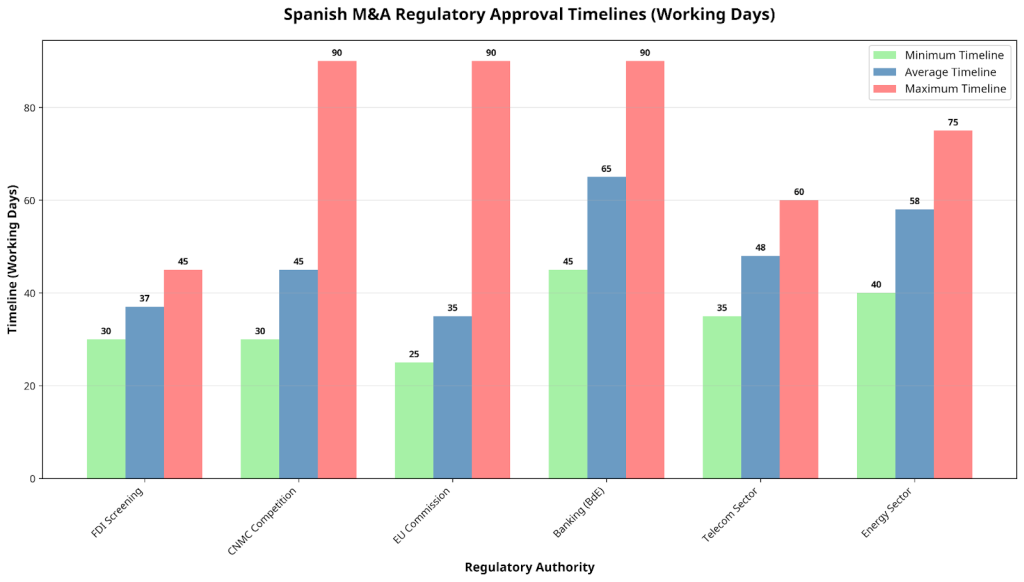

- The Directorate-General for International Commerce and Investments, part of the Ministry of Economy, oversees the FDI screening process, chairs the Foreign Investment Board, and manages authorisations under Royal Decree 571/2023.

- For defence-related deals, reviews are carried out by the Ministry of Defence with input from the Board, made up of other ministries and the CNI. Final approval in all cases rests with the Spanish Council of Ministers.

- Non-EU investors acquiring 10% or more of a Spanish company in strategic sectors must obtain prior approval.

Competition Law and Merger Control

- Merger control and competition law in Spain follow both national and EU oversight.

- Filing is required when combined turnover in Spain exceeds €240 million, or when the target generates more than €60 million locally.

Other key considerations in Spanish M&A

- Due diligence for acquisitions in Spain remains vital to assess risks, liabilities, and compliance.

- Transaction costs and fees in Spanish M&A should be factored into early planning to avoid surprises.

- Using tax-efficient structuring for Spanish M&A, including the participation exemption regime, can significantly reduce the tax burden.

- Choosing the right structure, share acquisition vs. asset acquisition, depends on liability, flexibility, and tax considerations.

| Merger Control Thresholds and Procedures | ||||

|---|---|---|---|---|

| Authority | Turnover Threshold | Geographic Scope | Review Timeline | Remedy Options |

| Spanish CNMC | €240M combined Spanish | Spanish market impact | 30 days (Phase I) | Behavioural / Structural |

| EU Commission | €5B worldwide | EU-wide significance | 25 working days (Phase I) | Comprehensive remedies |

| Sectoral Regulators | Sector-specific | Industry-focused | Variable timelines | Sector-specific conditions |

Legal due diligence in Spain

In cross-border M&A Spain , due diligence means checking for risks, hidden costs, and future obligations.

- Corporate and Commercial: Review the company’s structure, shareholder agreements, governance, key contracts, and intellectual property.

- Labour: Understand employee contracts, collective agreements, benefits, redundancy rules, and relations with works councils.

- Tax & Finance: Check past tax filings, potential liabilities, VAT, and international tax issues that could affect the deal.

- Regulation & Environment: Ensure compliance with licences, permits, ESG rules, and GDPR/data protection laws.

M&A within the Comunidad Valenciana

Valencia has become one of Spain’s top regions for international M&A thanks to its strategic location, business-friendly policies, and strong infrastructure.

- Incentives: Regional grants and tax breaks are designed to attract foreign investment and create jobs.

- Infrastructure: With a world-class port, excellent transport links, and advanced telecoms, Valencia is an ideal base for European operations.

- Key Sectors: Strong opportunities exist in manufacturing and automotive, while Valencia’s tech and startup ecosystem is booming in fintech, biotech, renewables, and digital services.

Understanding the local legal and regulatory framework is vital for successful cross-border M&A Spain deals.

At Delaguía y Luzón, we provide professional M&A advisory in Spain, helping international investors navigate due diligence, tax structuring, and regulatory approvals with confidence.

Your partner for M&A success in Spain

Cross-border M&A Spain can be complex, but the right guidance makes all the difference.

With expert support, investors can navigate due diligence, tax structuring, regulatory approvals, and post-deal integration smoothly and with confidence.

At Delaguía y Luzón, we bring over 65 years of Spanish legal expertise, a 90% international client base, and a multilingual team fluent in Spanish, English, French, and Russian.

Our track record spans acquisitions, joint ventures, and regulatory clearances across multiple sectors.

Ready to explore M&A opportunities in Spain?

Contact our team today for a confidential consultation and discover how we can help you structure, negotiate, and complete your transaction successfully.

FAQS cross-border M&A in Spain

Why invest in Spain?

Spain offers a strategic location between Europe, Latin America, and North Africa, a strong legal framework, and tax-efficient structures under EU directives. Sectors like technology, healthcare, and renewable energy are especially attractive for foreign investors.

What legal issues matter most?

Key points include due diligence, FDI approvals, merger control rules, and tax-efficient structuring.

What is FDI screening?

Non-EU investors buying 10%+ of a Spanish company in sensitive sectors (defence, energy, telecoms, infrastructure) need prior government approval.

What deal structures are possible?

Options include share deals, asset deals, joint ventures, and cross-border mergers under EU law.

When is merger filing required?

If the combined turnover in Spain exceeds €240M, or if the target earns more than €60M locally. Large global deals may fall under EU Commission control.

What checks are done in due diligence?

Reviews cover company structure, contracts, employees, taxes, compliance, intellectual property, and environmental matters.

Why use M&A advisors in Spain?

Cross-border M&A is complex. Professional M&A advisory in Spain, like Delaguía y Luzón, ensures smooth handling of compliance, structuring, approvals, and integration.