Key takeaways

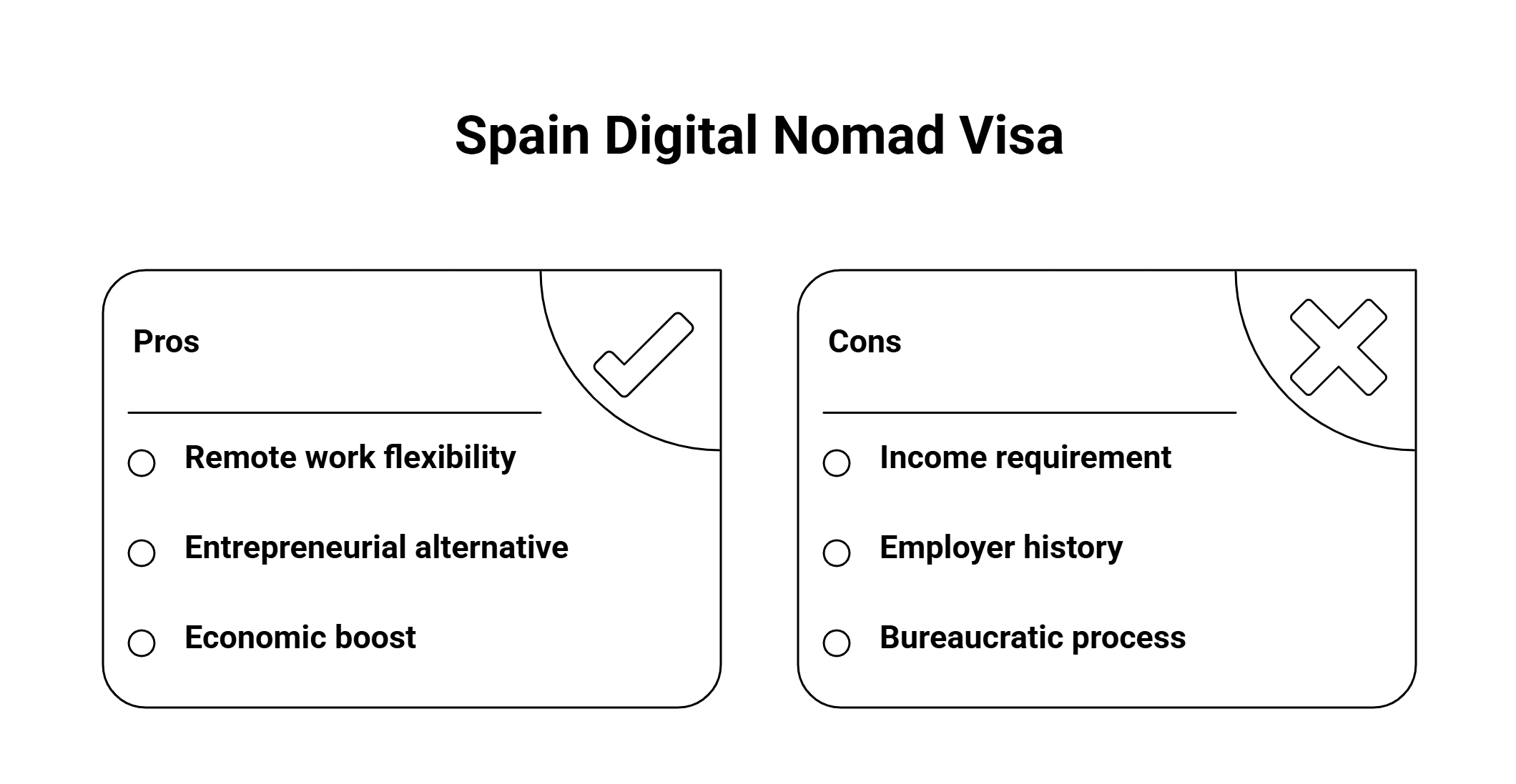

- The Spain digital nomad visa for W-2 employees allows eligible U.S. remote workers to live legally in Spain while remaining employed by a foreign company.

- Applicants must meet the 2026 minimum income threshold (approx. €2,763/month) and demonstrate a valid remote employment relationship with a company operating for at least one year.

- W-2 employees typically need a Certificate of Coverage or an alternative social security compliance solution to avoid double contributions.

- The residence permit can be issued for up to 3 years (if applied from Spain), renewable for additional periods, and may provide access to special expat tax regimes depending on eligibility.

Spain Digital Nomad Visa for W-2 employees

Spain’s Digital Nomad Visa for W-2 employees has become one of the most attractive immigration options for remote professionals worldwide.

However, for U.S. workers employed under a W-2 contract, the process is more complex due to social security coordination rules between the United States and Spain.

Understanding how U.S. employment classification interacts with Spanish immigration and tax systems is essential before starting an application for the Spain Digital Nomad Visa for W-2 employees.

This guide explains the current legal framework, the social security challenges affecting W-2 employees, and the practical strategies available for successfully obtaining Spain’s Digital Nomad Visa.

If you want a full procedural guide, see our step-by-step article on how to apply for the digital nomad visa in Spain.

Understanding Spain’s Digital Nomad Visa

Spain introduced the Digital Nomad Visa (Visado de Teletrabajador de Carácter Internacional) under the Startup Law, allowing non-EU citizens to live in Spain while working remotely for foreign employers.

Entrepreneurs considering launching a business instead may explore the Spanish startup visa as an alternative pathway.

Applicants must generally demonstrate that at least 80% of their income originates outside Spain and that their employer has operated for at least one year.

Minimum income requirements

Income thresholds are tied to Spain’s Salario Mínimo Interprofesional (SMI).

As of 2026, applicants must meet the following:

- Main applicant: approximately €2,763/month

- First dependent: additional €1,036/month

- Each additional dependent: €346/month

What makes the Spain Digital Nomad Visa for W-2 employees different?

W-2 employees remain subject to U.S. payroll taxation, which creates additional compliance considerations when relocating abroad.

Spain requires applicants to demonstrate social security coverage either through a Certificate of Coverage or through Spanish social security registration.

| The certificate of coverage requirement |

|---|

A Certificate of Coverage confirms that the worker remains insured under the U.S. system and therefore does not need to contribute simultaneously to Spanish social security. Without this document, applicants must obtain compliant Spanish health insurance and register locally after arrival. To better understand medical coverage obligations, see our guide to the Spanish healthcare system. |

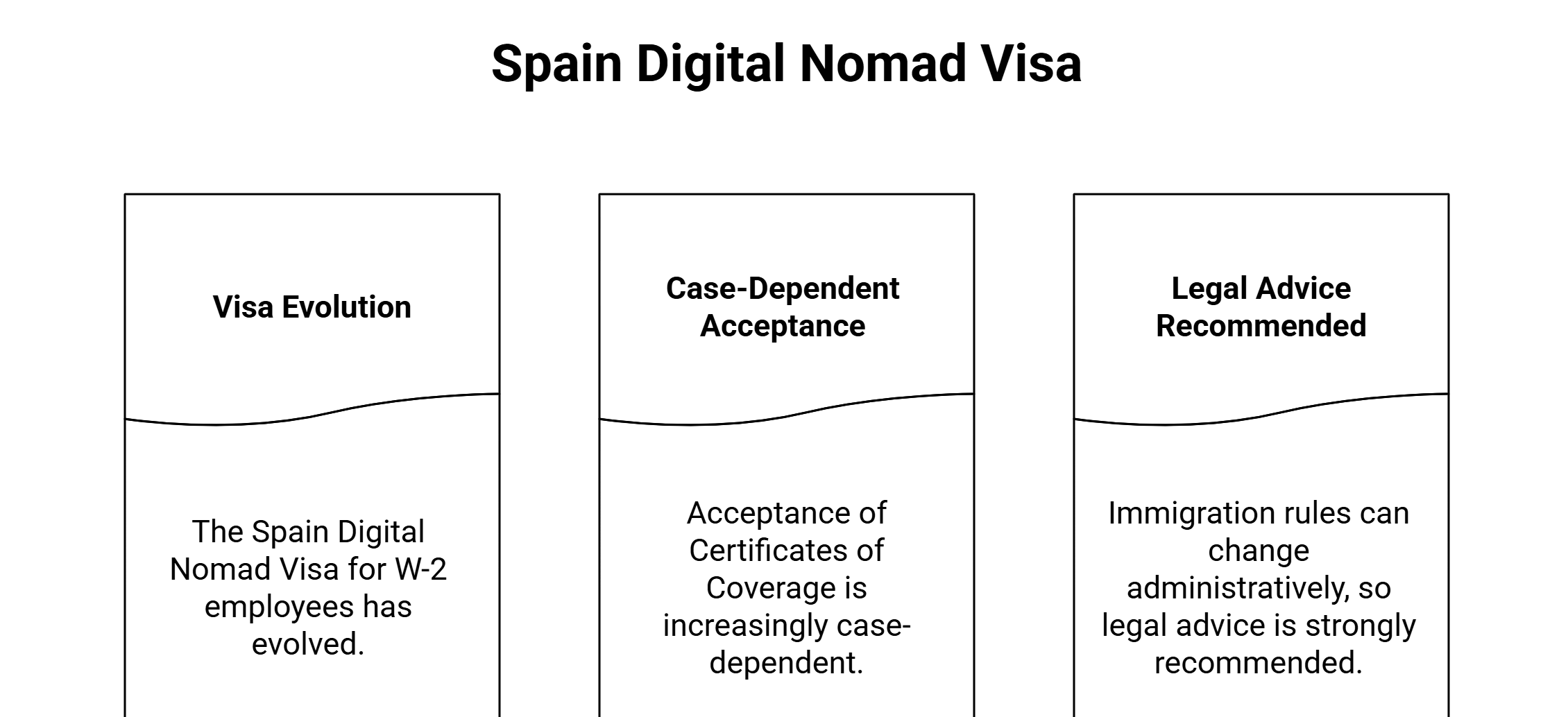

Policy changes affecting the Spain Digital Nomad Visa for W-2 employees

Since the introduction of the Spain Digital Nomad Visa for W-2 employees has evolved, with acceptance of Certificates of Coverage becoming increasingly case-dependent.

Because immigration rules can change administratively, professional legal advice is strongly recommended before applying.

Alternative compliance options

If obtaining a Certificate of Coverage is not possible, applicants may consider:

- Employer registration in Spain

- Conversion to contractor status

- Private health insurance combined with Spanish social security registration

In some cases, individuals who cannot qualify for the digital nomad visa may instead evaluate the Spanish non-lucrative visa.

Tax considerations for foreign workers

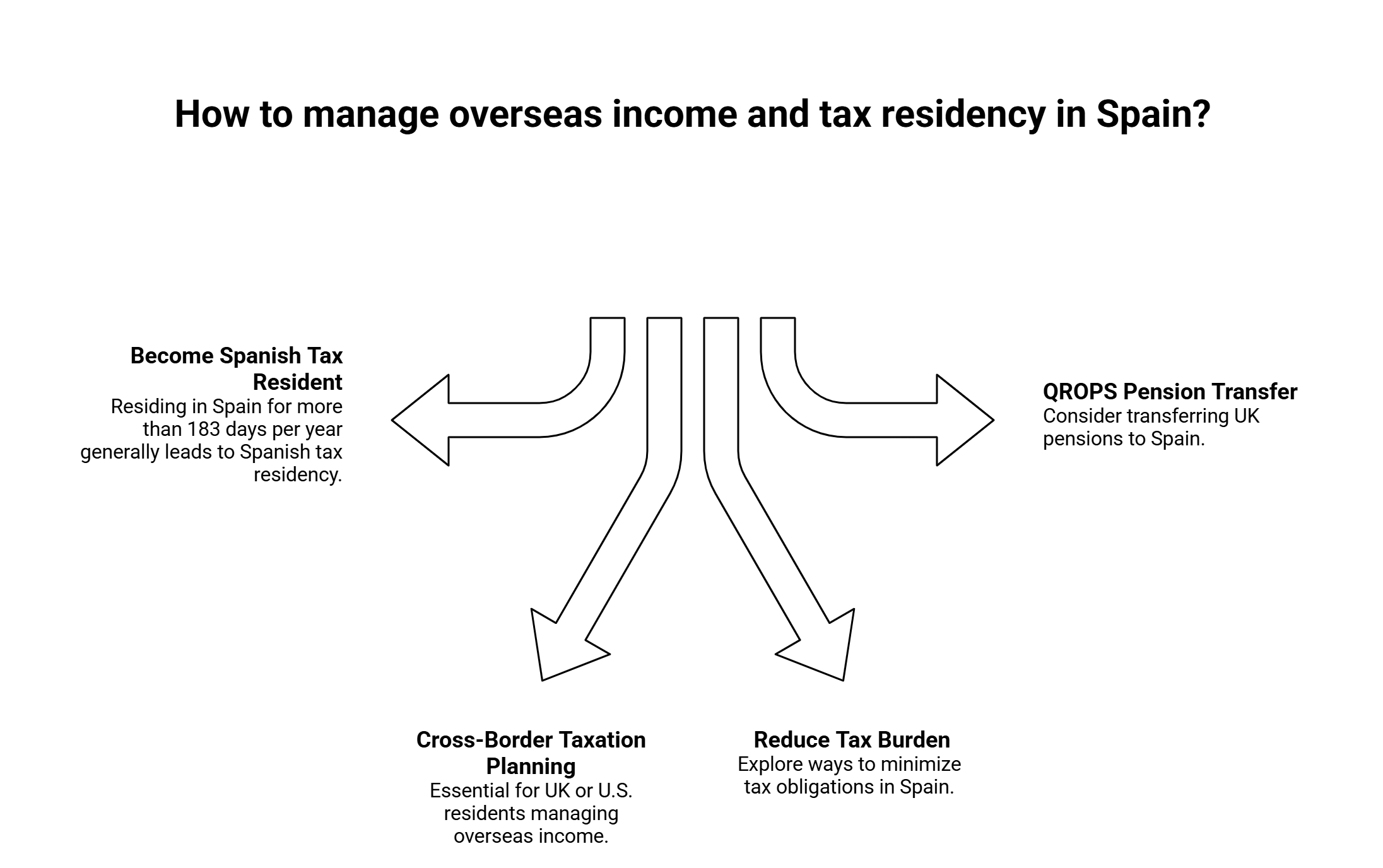

Individuals residing in Spain for more than 183 days per year generally become Spanish tax residents.

Cross-border taxation planning is essential, particularly for UK or U.S. residents managing overseas income.

Digital Nomad Visa application process

Applicants may apply at a Spanish consulate abroad or from within Spain.

Overstaying a tourist visa while preparing an application can create serious legal complications, so it is important to review the risks of overstaying a visa in Spain.

Individuals already living irregularly in Spain may explore alternative legal pathways, such as extraordinary regularisation for foreigners in Spain.

Residency, property, and long-term relocation planning

Many digital nomads later choose to purchase property or establish businesses in Spain.

Helpful related resources include:

- Buying property in Spain

- Legal fees when buying Spanish property

- Spanish mortgage review

- Regional property taxes in Spain

- Legalising unregistered property in Spain

Business relocation and corporate considerations

Companies relocating staff to Spain should carefully review the legal frameworks governing cross-border employment and international agreements to ensure full compliance with local regulations.

Employers may find it useful to consult guidance on international contracts in Spain and legal support for international residents.

Partner with a professional immigration lawyer

The Spain Digital Nomad Visa for W-2 employees remains one of the most appealing residency programmes for remote professionals.

Early planning, professional tax guidance, and proper documentation significantly improve approval chances.

Professional legal support for your Spain digital nomad visa for W-2 employees

Contact Delaguía y Luzón today to ensure your application is properly structured, meets social security compliance requirements, and is fully aligned with Spanish immigration regulations.

- Email: felix.delaguia@delaguialuzon.com

- Phone: +34 963 74 16 57

FAQ: Spain Digital Nomad Visa

Can W-2 employees apply for Spain’s Digital Nomad Visa?

Yes. U.S. W-2 employees can apply, provided they meet the income, employment, and social security coverage requirements established by Spanish immigration authorities.

Do W-2 applicants need a Certificate of Coverage?

In most cases, yes. The Certificate of Coverage proves that the employee remains covered by the U.S. social security system and avoids double contributions in Spain. If it cannot be obtained, alternative compliance solutions may be required.

What income is required for the visa?

As of 2026, the main applicant must generally demonstrate monthly income of approximately €2,763, with additional income requirements for dependants.

Will I pay taxes in Spain as a digital nomad?

If you live in Spain for more than 183 days per year, you will typically become a Spanish tax resident and may be required to declare worldwide income, subject to applicable tax treaties and special regimes.

Can I apply from Spain or must I apply from abroad?

Applicants may apply either at a Spanish consulate abroad or from within Spain, depending on their immigration status at the time of application.